Hanoi Apartment Prices Expected to Rise 6-8% Despite Fewer Transactions

Many real estate experts believe that despite the current slowdown in Hanoi’s apartment market, a price drop is unlikely in the near future. Instead, the general consensus is that prices will continue to rise steadily, driven by a combination of limited supply, strong demand, and broader economic factors influencing investment decisions.

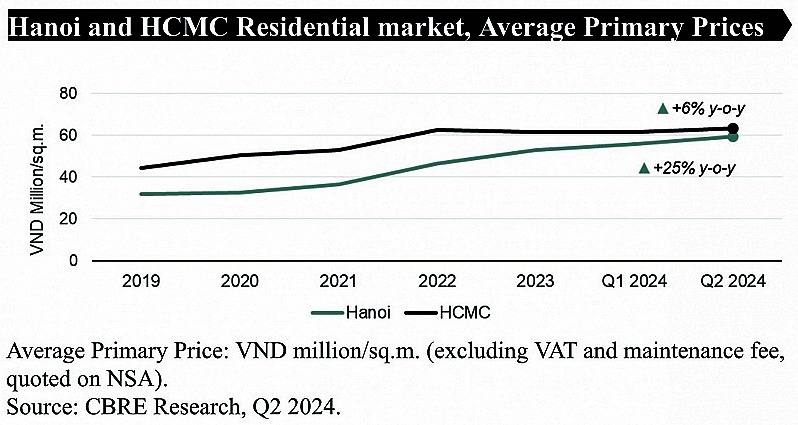

According to a recent report by CBRE, 2024 saw secondary apartment prices in Hanoi surge by more than 26%, marking the highest annual increase ever recorded for the city. The average price reached approximately 48 million VND per square meter. While this sharp upward trend is expected to slow down in early 2025, the report still predicts an average annual increase of 6-8% for apartment prices throughout the year. This forecast reflects persistent supply shortages and growing housing demand across various districts of the capital.

Price Drops Are Unlikely: A Market Analysis

Mr. Trần Quang Trung, Business Development Director at OneHousing, highlighted that waiting for apartment prices to decrease in 2025 is an unrealistic expectation. He drew an analogy between the real estate market and luxury car prices to illustrate his point. For instance, while many believe car values typically depreciate over time, high-end models like the Lexus 570 have defied this logic. In 2009, the price of a Lexus 570 was around 4 billion VND, but today, that same car can fetch upwards of 8 billion VND. This trend reflects how premium assets tend to appreciate over time rather than lose value—paralleling the trajectory of Hanoi’s apartment market.

In the case of real estate, although new housing supply could improve between 2026 and 2027, developers are more likely to introduce promotional offers or discounts only when faced with increasing competition. However, this scenario is unlikely to materialize within 2025, meaning buyers should not expect significant price reductions in the short term.

Long-Term Factors Driving Price Growth

At the seminar titled “Hanoi Apartment Market: Where Are Sustainable Living and Investment Opportunities?”, Mr. Ngô Hữu Trường, Deputy General Director of Hưng Thịnh Group, shared his insights on why apartment prices in Hanoi will be hard to reduce in the foreseeable future. Real estate has long been regarded as a store of value, especially in Asian countries like Vietnam, where cultural attitudes toward land and property as symbols of wealth and long-term investment remain deeply entrenched.

Other economic factors are also at play. The recent surge in gold prices and fluctuating exchange rates has led investors to seek safer, more stable assets, further driving interest in real estate. Many investors now view property as a hedge against inflation, contributing to the rising demand for apartments in Hanoi’s central and suburban districts.

Domestic gold prices continue to rise, with jewelry gold reaching an all-time high. As of 10:00 AM on February 25, SJC listed gold bullion at 90 million VND (buying) and 92.3 million VND (selling), up 300,000 VND per tael from the previous session. The buy-sell gap stands at 2.3 million VND per tael.

Gold Prices Hit Record High in Vietnam

Supply Shortages Continue to Limit Market Growth

Ms. Nguyễn Minh Chi, Deputy General Director of Phú Tài Land, pointed out a critical issue: the imbalance between supply and demand. Current housing supply is failing to meet the increasing demand for apartments, particularly in Hanoi’s inner-city districts. The number of new projects being launched in these areas is steadily declining, leading to growing competition for available properties.

Surveys indicate that in some districts, new developments have become exceedingly rare. For example, Hoàng Mai District currently has only one new residential project underway, while districts like Thanh Xuân and Hà Đông are home to just one or two active developments each. As the number of available apartments dwindles, competition intensifies, inevitably driving prices higher.

Growing Demand Driven by Demographic Shifts

Beyond supply issues, rising demand is also fueled by the city’s demographic changes. Each year, thousands of students move to Hanoi for higher education, while recent graduates entering the workforce add to the growing pool of individuals seeking housing. This influx of newcomers places additional pressure on the housing market, as many aspire to settle down and purchase their first home.

In addition, internal migration patterns show a steady increase in people relocating from rural areas or smaller cities to Hanoi in search of better job opportunities. This migration trend is expected to continue in the coming years, further fueling demand for affordable housing options across the capital.

Policy Implications and Urban Expansion

From a policy perspective, Hanoi’s government has been working on urban expansion plans aimed at accommodating the rising population and increasing housing demand. Suburban districts are witnessing the development of new infrastructure projects, such as roads, schools, and public transportation networks, designed to ease congestion in the city’s core areas. However, despite these efforts, the supply of new residential projects in central districts remains extremely limited.

The scarcity of land in prime locations also poses a significant challenge. As the availability of land for residential development in the inner city continues to shrink, property values in these areas are expected to rise even further. Unless significant policy changes or large-scale development projects are implemented, this trend is unlikely to reverse anytime soon.

Conclusion: A Market Set for Continued Growth

In conclusion, Hanoi’s apartment market is poised for continued growth in 2025 and beyond. Despite a temporary slowdown in transactions, the fundamental factors driving demand—such as urbanization, population growth, and limited supply—remain strong. Potential buyers and investors should adjust their expectations accordingly, as waiting for prices to drop may lead to missed opportunities in an increasingly competitive market.

For those looking to invest in Hanoi’s real estate sector, the next few years may represent a critical window to secure properties before prices climb even higher, particularly as infrastructure improvements and urban expansion projects reshape the city’s housing landscape.